- Home

- About Us

- The Team / Contact Us

- Books and Resources

- Privacy Policy

- Nonprofit Employer of Choice Award

The events mentioned in this article are true. The details have been altered to preserve the privacy of the people and organizations involved.

Staff Efficiency vs. Temptation

Staff Efficiency vs. Temptation

Charities are under constant pressure to minimize the cost of administration. Accounting technology advances have reduced the need for administrative staff. Your system can now pull invoices from vendors, account for them and set them up for payment, all without human intervention. Where a typical small to medium sized charity would have two full time staff with part time help from the receptionist, now there might be only one person and even then, that person may be part time.

Unfortunately, all of these efficiency gains apply as much to unauthorized transactions as to legitimate ones. As an auditor, I used to rely on transactions having to pass through multiple hands in order to get processed. The more people that had to be involved, the more difficult it would be to falsify or hide fraudulent transactions. I would make sure that different people accounted for the money than handled it. The person who accounted for the banking could not be the same person who deposited the money. That kind of segregation of incompatible functions is getting difficult to achieve, particularly in charities.

When a church bookkeeper handled all of the financial functions, from payroll, to banking, credit card processing and depositing the collection, the temptation to include personal payments with the church’s transactions became too great. Because the ministers handed in their receipts without looking at the credit card statements, the bookkeeper was able to charge internet purchases to the credit cards without being noticed. Because the bookkeeper also prepared the budget and inflated the expenses to make room for the unauthorized transactions, even the Treasurer’s financial analysis did not identify the problem, which went undetected for years.

Credit Card Opportunity vs. Temptation

Credit cards are a fast and easy way to make payments and they often offer to pay a percentage of the purchases back in the form of points that can be used for other purchases. But you need to weigh the 1% you get back against the need to maintain accountability.

The idea sounded good: let’s put the sports arena payments for a children’s charity tournament on the coach’s personal credit card and use the credit card’s loyalty points to hold a pizza party for the children. A cheque was written to the coach who was supposed to use the money to pay the arenas. The arenas were remarkably patient. They didn’t start following up on why they hadn’t been paid until several months after the tournament. When the volunteer bookkeeper found out that the arenas hadn’t been paid, they felt personally responsible and spent many hours analyzing what had happened and following up. In this case, the person responsible was confronted with the situation and they reimbursed the organization.

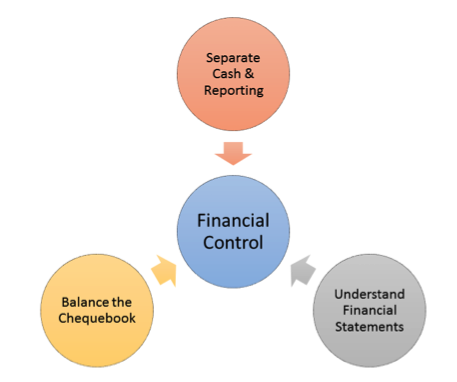

What is Financial Control?

If your organization is audited, there will be a “Management Letter” listing the auditor’s recommendations for your system. The recommendations are a good place to start, but they deal with control weaknesses in your current system. They do not attempt to address what the best system for you is. So let’s start with three basic principles: transparency, incompatible duties and reconciliations.

Transparency – Your best defense is knowledge. When people know what to expect, they are in a position to question transactions that appear out of place.

Transparency – Your best defense is knowledge. When people know what to expect, they are in a position to question transactions that appear out of place.

Incompatible Duties – Avoid tempting people by making sure that if they handle money (or authorize online transactions) they don’t also record the transactions in the accounting or fundraising systems. If they take in money, don’t let them pay it out. Everything goes through the accounting system. Money should always be counted with at least two people present. Even online payments can be set up so that two people are required to authorize them.

Reconciliations – When information is captured by different and independent systems, a reconciliation proves the accuracy of both. For example, you and your bank both record the cash transactions affecting your cash. A monthly reconciliation makes sure that all of the transactions have been recorded and that neither side has made a mistake. If your fundraising system posts automatically to the accounting system, then the bank reconciliation helps show that all of the donations deposited in the bank were recorded in the fundraising system.

You Don’t Trust Me?

It’s hard to talk about financial control without raising the issue of trust. Try to keep trust out of the conversation. Make it a discussion of systems, not people, but the reality is that all of the people implicated in fraud cases were trusted at the time they took the money. We don’t know the pressures that others live under. The point to make is that good controls protect staff from suspicion. If there are two people counting the collection, then there will be no suspicion if the count ends up short.

There is another side to trust: responsibility. In an online bookkeeping forum, one participant asked whether others were comfortable making payments on behalf of their clients. The resounding response was no. The bookkeepers were happy to print the cheques or set up invoices online for payment, but they wanted their clients to sign or click on the payment button, i.e. take responsibility for the actual payment. And that’s how it should be.

Bottom Line: Convenience vs. Control

So what do you do? Do you embrace the convenience of internet banking or insist on the old controlled way of authorizing paper documents by hand? This is one area where with some planning you can eat your cake and have it too. Work with your auditor and your banker to set up a convenient system that gives you the assurance of good financial controls. For example, allow the bookkeeper to set up invoices for payment, but require the Executive Director to approve the actual bank transactions.

For a more detailed discussion of this issue, contact Bill Kennedy, CPA, CA at http://EnergizedAccounting.ca . Bill is a Certified Information Technology Professional and QuickBooks Online ProAdvisor who works with charities to produce clear financial reports and update computer systems.