- Home

- About Us

- The Team / Contact Us

- Books and Resources

- Privacy Policy

- Nonprofit Employer of Choice Award

Got salary questions?

Got salary questions?

As a donor, "Have I looked at the financials of my favourite charity so I can ask appropriate questions to them?"

As a Board member, "Are our salaries aligned with how much the leadership at a similar charity earns?"

As an employee, "Could I make a reasonable living working in the charitable sector?"

Fortunately, there are a lot of great resources for you to learn more. Best of all, many of these are free and just a few clicks away.

Government "sunshine" lists

If the charity receives government money, you are in luck in some Provinces where the salaries of high level employees are published. This is true in BC, Alberta, Manitoba (you have to google a lot to find it for each organization), Ontario, New Brunswick, Nova Scotia, and Newfoundland and Labrador. Based on these links, you can use this information to make some informed guesses about what the salary range should be for your role.

For example, if your new boss is at the Director level and making $101,000 and all the other Directors at that charity are making that amount, then you can assume you are below that. On the other hand, if the three male directors at your organization are all making $101,000 according to public disclosure salary reports and you, the lone female, are making less, that is something you can bring when you decide to negotiate an increase.

Professional Associations

Several of the professional associations have free access to a wage and benefit study for their members. Non-members can often buy the study. In healthcare, AHP publishes a Canadian study. In education, CASE has a North American Compensation Database, AFP has a Canadian survey that covers the sector broadly.Each report is quite detailed and contains information on a wide range of organization types as well as a wide range of jobs.

Bearing in mind the $14,000 a year wage gap between male and female fundraisers, it is worth it to buy access to one of these reports. For the cost of a few hundred dollars, you can avoid missing out on thousands of dollars.

Canada Revenue Agency website

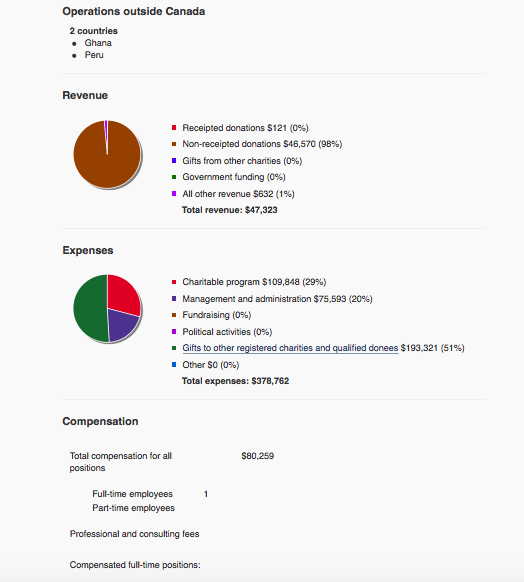

A great way to find out more about the charity is to check out their financial information on the Canada Revenue Agency website. Below are a set of screen shots to help you find salary information. Step one is to get to the Government of Canada website for charity listings. Search on the charity name.

After you find the charity's listing, you have a sense of the salary ranges. For example, in this charity below, the charity only has one employee who makes $80,000 a year. So, if you are applying for a job at this place, you know what your boss makes. Or if you are applying to be the CEO, what your predecessor makes. This is handy in helping you understand the pay range at a particular charity.

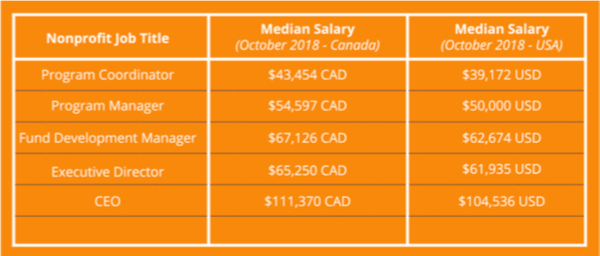

Earlier this year, Keela sponsored a recent study using data from Payscale. They looked specifically at the median salary, without looking at bonuses or any extra income (as these varied quite a bit). The full report is here.

Here is the data and some of the interesting findings:

This year, Charity Village sponsored an update of their Canadian Nonprofit Sector Salary and Benefits Study The survey collected compensation and profile data for six staff levels. You can get the full report here.

As a donor or Board member, you might want to go deeper and see that employees of a charity are compensated with a living wage and that women, people of colour, and people with disabilities are fairly treated.

As a charity employee, this information should help you negotiate better for yourself.